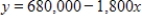

A $680,000 property is depreciated for tax purposes by its owner with the straight-line depreciation method. The value of the building y, after x months of use is given by  dollars. After how many months will the value of the building be $377,000? Round your answer to the nearest whole number of months.

dollars. After how many months will the value of the building be $377,000? Round your answer to the nearest whole number of months.

Definitions:

Literature Major

An academic program that focuses on the study, analysis, and critique of written works, including poetry, novels, and texts, across various cultures and historical periods.

Failing Grade

An academic grade symbolizing that a student's performance did not meet the defined minimum standards.

Peak Performer

An individual who consistently achieves top performance levels in their specific field.

Eating Sweets

The consumption of food items high in sugar, often categorized as comfort or pleasure foods but generally low in nutritional value.

Q17: Use the rules of exponents to simplify

Q41: Find x, y, z and w.

Q61: The final grade received in a Literature

Q66: Solve the equation by using the quadratic

Q98: If <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1243/.jpg" alt="If ,

Q103: The given matrix is an augmented matrix

Q200: Choose the inequality that describes the interval

Q210: Compute and simplify so that only positive

Q241: Evaluate the following expression if it represents

Q289: Evaluate the following expression if it represents