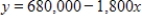

A $680,000 property is depreciated for tax purposes by its owner with the straight-line depreciation method. The value of the building y, after x months of use is given by  dollars. After how many months will the value of the building be $377,000? Round your answer to the nearest whole number of months.

dollars. After how many months will the value of the building be $377,000? Round your answer to the nearest whole number of months.

Definitions:

Liquidator's Distribution

The process of distributing assets held by a company under liquidation to its creditors and shareholders.

Shareholders' Distribution

The allocation of earnings declared by a corporation to its shareholders, usually in the form of dividends.

Liquidation Account Purpose

The objective of tracking and managing all financial transactions during a company's liquidation process to ensure fair distribution of assets to creditors and shareholders.

Contributories

Individuals or entities that are liable to contribute to the assets of a company in the event of its winding up.

Q3: Solve the inequality. <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1243/.jpg" alt="Solve

Q8: The table below shows the national expenditures

Q10: A manufacturer of microwave ovens wants to

Q43: Factor the expression as a product of

Q49: Nominal data are also called qualitative or

Q68: The model for body-heat loss depends on

Q164: In a survey of the dining preferences

Q178: The graphs of the two equations below

Q197: Use a graphing utility with the standard

Q265: Perform the indicated operations and simplify.