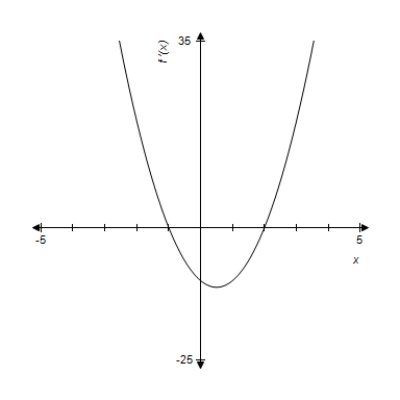

A graph of  is given. Use the graph to determine all critical values of

is given. Use the graph to determine all critical values of  .

.

Definitions:

Social-Cognitive Theory

The view that personality can be defined as a collection of learned behaviors acquired through social interactions.

Theories of Learning

A set of principles and ideas which explain how people acquire new knowledge, skills, behaviors, and attitudes.

Environment

The surroundings or conditions in which a person, animal, or plant lives or operates.

Personality

The combination of characteristics or qualities that form an individual's distinctive character, affecting thoughts, feelings, and behaviors.

Q1: For the given equation, find the slope

Q22: The following figure shows the growth of

Q33: Approximate the area under the curve over

Q48: An inferior product with a large advertising

Q51: Find <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1243/.jpg" alt="Find .

Q58: The monthly demand function for x units

Q61: Newton's law of cooling (and warming) states

Q117: The graph of a company's profit function

Q119: If the supply function for a commodity

Q142: The consumer price data can be modeled