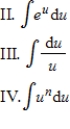

Determine the most appropriate method or integral formula for evaluating the given integral. Next, evaluate the integral.

I. Integration by parts

Definitions:

Excessive Absenteeism

A habitual pattern of absence from a duty or obligation, surpassing normal levels, often impacting productivity and team dynamics.

Q13: A decision criterion that weights the payoff

Q29: If <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1243/.jpg" alt="If ,

Q30: Find the general solution of the differential

Q30: Evaluate the improper integral if it converges,

Q53: A function and its graph are given.

Q55: Find any horizontal asymptotes for the given

Q61: Suppose that the production function for a

Q77: Evaluate the integral <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1243/.jpg" alt="Evaluate the

Q88: Use integration by parts to evaluate the

Q131: Find <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1243/.jpg" alt="Find if