Sorites 1E

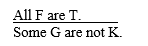

Given the following sorites:

All F are G.

No T are N.

Some K are N.

-For Sorites 1E, the first intermediate conclusion is:

Definitions:

Systematic Risk

The inherent risk that affects the entire market or a certain segment of the market, often influenced by factors like political, economic, and interest rate changes that cannot be mitigated through diversification.

Firm-specific Risk

The type of risk that affects a particular company or industry, as opposed to systemic risk, which affects the entire market.

Correlation Coefficient

A statistical measure that describes the extent to which two variables fluctuate together, ranging from -1 (perfect negative correlation) to +1 (perfect positive correlation).

Covariance

A measure of the degree to which two variables move in relation to each other, indicating the direction of their relationship.

Q15: For Syllogistic Form 6A, after filling in

Q45: Norwegian improves its entertainment only if both

Q58: For Syllogistic Form 2F, the mood and

Q135: For Sorites 1C, the correct answer is:<br>A)

Q189: All A are non-B. (F) Contrary<br>A) No

Q236: For Syllogism 4F, the major premise is:<br>A)

Q274: After reducing the number of terms in

Q280: It is false that all ballet performances

Q333: Princess drops its dress codes or Oceania

Q414: Which of the following categorical propositions is