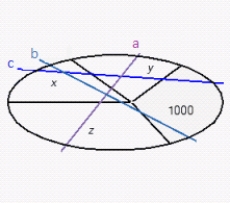

Use the table and the given X-ray absorption diagrams to identify the composition of each of the regions marked by a letter. The number in each region shows its absorption, and the number on each X-ray beam shows the total absorption for that beam.  , ,

, ,

x =

__________

y =

__________

z =

__________

Definitions:

Risk-free Security

A financial instrument considered to have minimal risk of default, often equated with the debt of a solvent government or government-backed entity.

Global Minimum-variance Portfolio

A portfolio constructed to achieve the lowest possible risk (variance), holding investments worldwide to diversify exposure.

Efficient Frontier

A graphical representation in modern portfolio theory showing the set of optimal portfolios that offer the highest expected return for a defined level of risk or vice versa.

Firm-specific Risk

The risk associated with an individual company, distinct from market risk, that can affect the company's stock price.

Q5: Minimize <span class="ql-formula" data-value="p =

Q49: The market research department of the

Q54: A surgical procedure requires choosing among three

Q117: Your total payment on a 8-year

Q129: You manage an ice cream factory that

Q130: If 10 persons meet at a reunion

Q136: Production of 1 unit of cologne requires

Q152: Use matrix inversion to solve the

Q154: Given <span class="ql-formula" data-value="f (

Q173: Use row reduction to find the