Use the following information to answer the following questions.

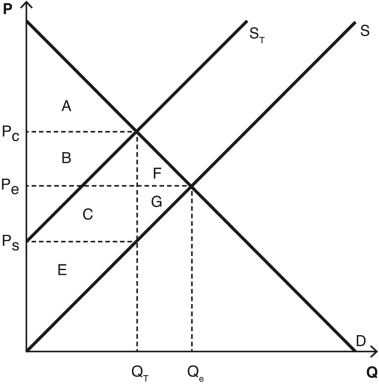

The following graph depicts a market where a tax has been imposed.Pe was the equilibrium price before the tax was imposed,and Qe was the equilibrium quantity.After the tax,PC is the price that consumers pay,and PS is the price that producers receive.QT units are sold after the tax is imposed.NOTE: The areas B and C are rectangles that are divided by the supply curve ST.Include both sections of those rectangles when choosing your answers.

-Which areas represent the revenue collected from this tax?

Definitions:

Shrimp Market

The global or local market involved in the trading and selling of shrimp, encompassing both wild-caught and farmed shrimp.

Excise Taxes

Excise taxes are taxes paid when purchases are made on a specific good, such as gasoline. They are often included in the price of the product.

Producer Surplus

This economic term represents the excess profit that producers make over the minimum amount they would be willing to accept for selling their goods, highlighting the benefit to sellers in a market.

Consumer Surplus

The variance between the sum consumers are ready and financially able to spend on a product or service and the sum they actually spend.

Q63: The equilibrium price of peanut butter is

Q82: All taxes create some deadweight loss except

Q119: If the number of buyers in a

Q122: The economists at JET Consulting consider Campbell's

Q126: The benefit to society from the imposition

Q126: Based on this scenario, who has an

Q139: What methods of product allocation might be

Q146: When a hurricane rips through Florida, the

Q163: The demand curve shift shown in the

Q170: Using any of the five foundations of