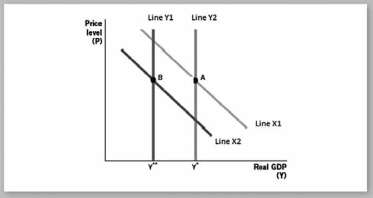

Use the image below to explain what happened to aggregate supply and demand during the Great Recession.

Definitions:

Taxable Income

The amount of an individual's or entity's income used to determine how much tax is owed, calculated by deducting allowable deductions from gross income.

Permanent Difference

A discrepancy between taxable income and accounting income that will not reverse over time, affecting the tax and financial reporting separately.

Life Insurance Proceeds

The money that beneficiaries receive from a life insurance policy upon the policyholder's death, typically exempt from income tax.

Interperiod Tax Allocation

The accounting technique of distributing tax expenses between different periods to match tax expenses with the revenues they are related to.

Q17: The Great Recession lasted from _ to

Q38: An important consequence of foreign-held debt is

Q52: Typically, the average tax rate for a

Q69: Suppose the marginal propensity to consume is

Q103: Sasha is about to leave on a

Q120: An increase in long-run aggregate supply can

Q122: The U.S. federal income tax began in<br>A)

Q156: If policymakers are concerned about the unequal

Q161: The portion of additional income that is

Q172: According to the table, the country with