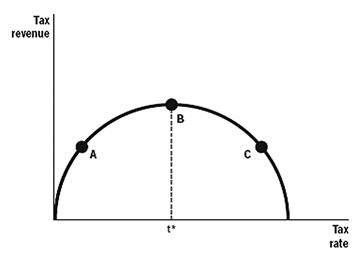

Refer to the following figure to answer the following questions.

-According to the figure,which point(s) would see tax revenues decrease if the tax rate increased?

Definitions:

Net Income

The total earnings of a company after subtracting all expenses, taxes, and costs from total revenue; also known as net profit.

Inventory System

A method for keeping track of the quantity, location, and status of goods a company has in stock.

Revenue Recorded

The process of documenting income earned by a business during a specific period, usually upon the delivery of goods or services.

Cost Flow Assumption

The method used to allocate costs to inventory and cost of goods sold, such as FIFO, LIFO, or weighted average.

Q2: Why do wealthy citizens contribute much higher

Q6: At _ tax rates, _ in those

Q13: When the economy falters, people often look

Q33: Contractionary fiscal policy occurs when the<br>A) government

Q89: The x axis for the Laffer curve

Q96: Classical economists believe that when aggregate demand

Q104: Tie fiscal policy initiatives to budget deficits

Q116: A recognition lag happens because<br>A) it takes

Q155: If the interest rate on a loan

Q155: Recognition lag, implementation lag, and impact lag