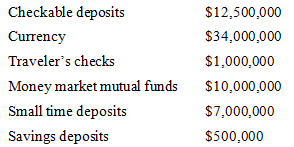

Refer to the following table to answer the following questions:

-What is the value of M1?

Definitions:

Social Security Tax

A payroll tax that funds the Social Security program, which provides benefits for retirees, disabled persons, and survivors.

Medicare Tax

A federal tax deducted from employees' wages and matched by employers to fund the Medicare program, providing health insurance for individuals over 65.

Unemployment Compensation Tax

A tax paid by employers based on the wages of their employees, used to fund the unemployment insurance program.

Social Security Tax

Mandatory contributions collected from employees and employers to fund the Social Security program, providing benefits for retirees, the disabled, and survivors.

Q14: The number of workers per Social Security

Q20: During economic downturns, particularly one like the

Q59: Spending on _, as a percentage of

Q85: Why did tax revenues fall so sharply

Q101: If St. John has a closed economy,

Q101: Unexpected inflation harms workers and other resource

Q122: If this country does not engage in

Q136: Classical economists stress the importance of aggregate

Q140: The y axis for the Laffer curve

Q159: If the Federal Reserve determined that banks