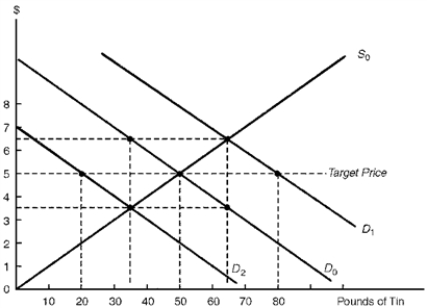

The diagram below illustrates the international tin market. Assume that producing and consuming countries establish an international commodity agreement under which the target price of tin is $5 per pound.

Figure 7.1. Defending the Target Price in Face of Changing Demand Conditions

?

-Consider Figure 7.1.Suppose the demand for tin decreases from D0 to D2.Under a buffer stock system, the buffer-stock manager could maintain the target price by

Definitions:

Business Risk

The exposure a company or investor faces due to uncertainties in the operating environment, impacting its profitability.

Contribution Margin

The selling price per unit, minus the variable cost per unit, indicating the contribution towards covering fixed costs and profit.

Business Risk

The potential for loss or failure in a business operation due to factors like market conditions, financial instability, or operational challenges.

Financial Risk

The possibility of losing money on an investment or business venture, including market risk, credit risk, liquidity risk, and operational risk.

Q7: Consider Figure 6.1.Suppose the European government provides

Q23: It is widely agreed that import-substitution policies

Q26: Imagine that Amazon purchases a Japanese grocery

Q32: To protect its farmers from imports of

Q55: Tree farms are more biologically diverse than

Q106: The characteristics that have underlaid the economic

Q119: The recent technological advances in oil production,

Q142: The common agricultural policy of the European

Q152: In the early 1800s, southern states pressed

Q180: A specification of a maximum amount of