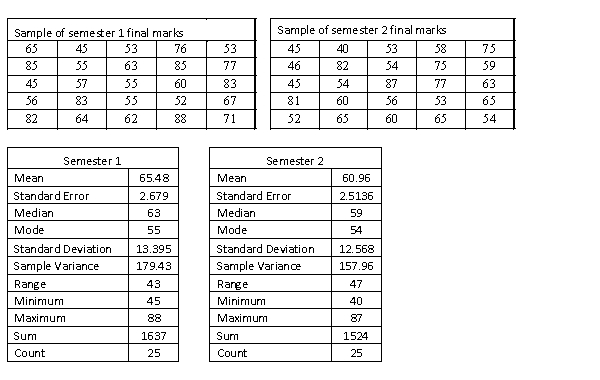

A statistics course at a large university is taught in each semester. A student has noticed that the students in semester 1 and semester 2 are enrolled in different degrees. To investigate, the student takes a random sample of 25 students from semester 1 and 25 students from semester 2 and records their final marks (%) provided in the table below. Excel was used to generate descriptive statistics on each sample.

Assume that student final marks are normally distributed in each semester.  (a) Determine whether these data are sufficient to infer at the 10% level of significance that the two population variances differ.

(a) Determine whether these data are sufficient to infer at the 10% level of significance that the two population variances differ.

(b) Explain the decision of your test in part (a) in the context of this question.

Definitions:

Maximizing Theory

A decision-making strategy aimed at choosing the option that offers the maximum potential benefit.

FR 10 Schedule

A fixed-ratio reinforcement schedule where reinforcement is provided after every tenth correct response, promoting high and steady rates of responding.

FR 40 Schedule

A type of fixed-ratio schedule where reinforcement is provided after a set number of responses, specifically 40 responses in this case.

Operant Chamber

An apparatus that creates an enclosed environment, used for the study of operant behavior within it.

Q3: Assuming that all necessary conditions are

Q8: An actuary wanted to develop a

Q12: A traffic consultant has analysed the

Q22: Which of the following best describes a

Q56: The trend equation for quarterly sales

Q109: A Wilcoxon rank sum test for comparing

Q110: Not much of foreign aid now flows

Q112: The following data represent the test

Q122: The purchasing power parity theory helps explain

Q132: If the coefficient of determination is 81%,