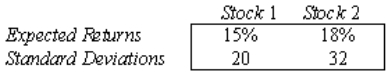

An analysis of the stock market produces the following information about the returns of two stocks:  Assume that the returns are positively correlated, with

Assume that the returns are positively correlated, with  12 = 0.80.

12 = 0.80.

a. Find the mean and standard deviation of the return on a portfolio consisting of an equal investment in each of the two stocks.

b. Suppose that you wish to invest $1 million. Discuss whether you should invest your money in stock 1, stock 2, or a portfolio composed of an equal amount of investments on both stocks.

Definitions:

Earth's Rotation

The spinning of the Earth on its axis, which takes approximately 24 hours to complete, resulting in day and night.

Organisms

Any living biological entities, such as plants, animals, fungi, or microorganisms.

Internal Desynchronization

A state in which biological rhythms are not in phase with one another.

Time Zones

Regions of the Earth that have adopted the same standard time, usually differing from neighboring regions by an exact number of hours.

Q8: Which of the following are factors that

Q39: A frequency distribution is a listing of

Q46: The average score for a class of

Q61: Suppose that your task is to estimate

Q73: The following data represent the weights (in

Q89: For a normal curve, if the mean

Q117: In a positively skewed distribution, the mean

Q266: Rational people make decisions at the margin

Q346: Which of the following products would be

Q383: Which of the following is not an