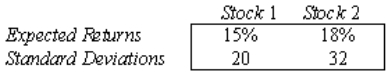

An analysis of the stock market produces the following information about the returns of two stocks:  Assume that the returns are positively correlated, with

Assume that the returns are positively correlated, with  12 = 0.80.

12 = 0.80.

a. Find the mean and standard deviation of the return on a portfolio consisting of an equal investment in each of the two stocks.

b. Suppose that you wish to invest $1 million. Discuss whether you should invest your money in stock 1, stock 2, or a portfolio composed of an equal amount of investments on both stocks.

Definitions:

Continental Rifting

The process by which the Earth's crust stretches, breaks, and eventually forms a new ocean basin, often associated with divergent plate boundaries.

Transform Faults

A type of fault where two tectonic plates slide past each other horizontally, commonly found at the boundaries of tectonic plates.

Intrusions

Geological features formed when magma cools and solidifies before reaching the surface, creating bodies of igneous rock.

Mid-Ocean Ridges

Underwater mountain ranges formed by plate tectonics, where new oceanic crust is generated from upwelling magma.

Q8: If A and B are independent

Q11: Is it possible to have two

Q14: Three candidates for the presidency of a

Q27: A sample of 16 observations has

Q39: If the event of interest is A,

Q46: According to an old song lyric, 'love

Q59: If we reject the null hypothesis, we

Q88: A supermarket receives a delivery each morning

Q298: Shane receives $100 as a birthday gift.In

Q358: When calculating the cost of college,which of