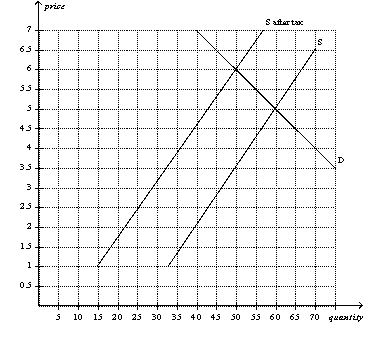

Figure 6-18

-Refer to Figure 6-18.Suppose the same supply and demand curves apply,and a tax of the same amount per unit as shown here is imposed.Now,however,the buyers of the good,rather than the sellers,are required to pay the tax to the government.After the buyers pay the tax,relative to the case depicted in the figure,the burden on buyers will be

Definitions:

Effective Feedback

Constructive and specific information or criticism that is intended to help improve performance or behavior.

Quality Analysis Report

A document detailing the outcome of a quality assessment process, highlighting strengths, weaknesses, and recommendations for improvements.

Defect Rate

The frequency at which errors or imperfections occur in a product, process, or service, typically expressed as a proportion of the total output.

Feedback Source

The origin, either a person or system, from which feedback is received.

Q6: Refer to Figure 6-15.Suppose a tax of

Q14: A tax burden falls more heavily on

Q37: Which of the following is correct? A

Q241: The price paid by buyers in a

Q243: Refer to Figure 6-3.A binding price floor

Q258: Suppose there is an early freeze in

Q308: Refer to Figure 6-11.If the government imposes

Q442: Refer to Figure 6-2.If the government imposes

Q492: If the government removes a tax on

Q511: If the government wants to reduce smoking,it