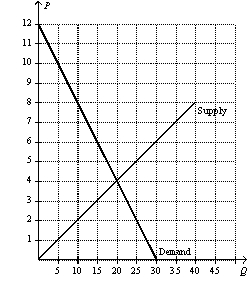

Figure 8-1

-Refer to Figure 8-1.Suppose a $3 per-unit tax is placed on this good.The tax causes the price paid by buyers to

Definitions:

Present Value Index

A calculation that compares the present value of project cash inflows with the initial investment, used in capital budgeting to evaluate profitability.

Compound Interest

The process of computing interest by including both the primary sum borrowed or deposited and the interest that has previously accumulated over time.

Estimated Cost

A prediction or approximation of the cost of goods or services, based on current and past information, before the actual expense is known.

Net Present Value

A method used in capital budgeting to determine the profitability of an investment by calculating the sum of its present values of all expected future cash flows.

Q10: If the tax on a good is

Q36: For Country A,the world price of soybeans

Q109: When externalities are present in a market,the

Q209: Refer to Figure 8-5.The benefit to the

Q245: Refer to Figure 8-6.When the tax is

Q301: If a country allows trade and,for a

Q370: Refer to Table 7-4.If the market price

Q374: Refer to Table 7-2.If Abbey,Bev,and Carl sell

Q382: The area below the demand curve and

Q444: Refer to Figure 8-1.Suppose a $3 per-unit