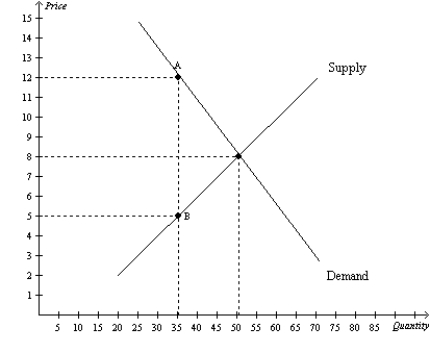

Figure 8-4

The vertical distance between points A and B represents a tax in the market.

-Refer to Figure 8-4.The per-unit burden of the tax on sellers is

Definitions:

Gross Revenues

The total sales revenue of a company without any deductions.

Internal Rate

Often refers to the internal rate of return (IRR), a metric used in capital budgeting to estimate the profitability of potential investments.

Cash Inflows

The total amount of money being transferred into a business, usually from operating, investing, and financing activities.

Discount Rate

The rate applied within discounted cash flow analysis for assessing the present worth of forthcoming cash flows.

Q24: Refer to Table 7-8.If Evan,Selena,and Angie sell

Q35: What happens to the total surplus in

Q48: Economists generally believe that,although there may be

Q70: Total surplus = Value to buyers -

Q78: Refer to Figure 7-20.If 10 units of

Q150: A tax placed on buyers of airline

Q238: When a country allows trade and becomes

Q243: With linear demand and supply curves in

Q284: A tax on a good<br>A) gives buyers

Q287: Which of the following is not correct?<br>A)