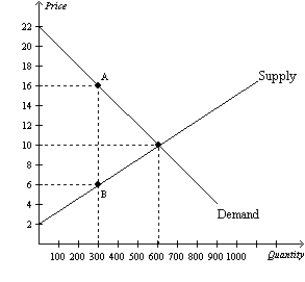

Figure 8-6

The vertical distance between points A and B represents a tax in the market.

-Refer to Figure 8-6.When the government imposes the tax in this market,tax revenue is

Definitions:

LIFO

Last-In, First-Out, an inventory valuation method where the most recently produced or purchased items are sold first, used for cost of goods sold calculation.

Pretax Income

The amount of income earned by a business before taxes have been deducted.

Ending Inventory

The total value of goods available for sale at the end of an accounting period, calculated as beginning inventory plus purchases minus cost of goods sold.

Inventory Error

Mistakes in counting or valuing inventory that can result in incorrect financial statements.

Q20: Suppose that Firms A and B each

Q86: Suppose there is an increase in supply

Q86: Diana is a personal trainer whose client

Q157: Refer to Figure 9-1.In the absence of

Q186: The deadweight loss from a tax<br>A) does

Q226: Refer to Figure 8-1.Suppose a $3 per-unit

Q264: Refer to Figure 8-5.The price that buyers

Q302: Producer surplus is the amount a seller

Q347: Refer to Figure 8-2.Consumer surplus without the

Q496: Market failure is the inability of<br>A) buyers