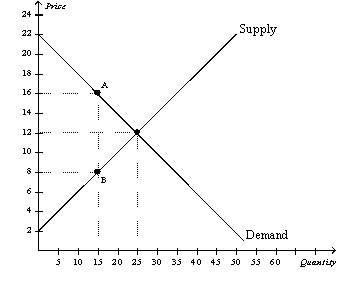

Figure 8-7

The vertical distance between points A and B represents a tax in the market.

-Refer to Figure 8-7.Before the tax is imposed,the equilibrium price is

Definitions:

Stock Investments

Financial assets representing ownership stakes in companies, which are bought and sold on stock exchanges, and can offer dividends and capital gains to investors.

Equity Method

The Equity Method is an accounting approach used for recording investments in associate companies where the investor has significant influence, typically 20-50% ownership, by recognizing its share of the associate's profits or losses.

Dividend Revenue

Income received from owning shares of stock in a corporation that pays dividends.

Operating and Financial Affairs

The various activities related to managing a company's day-to-day operations and handling its financial resources.

Q83: Refer to Figure 8-7.As a result of

Q122: Refer to Figure 8-2.The amount of deadweight

Q158: Suppose that policymakers are considering placing a

Q163: When markets fail,public policy can potentially remedy

Q197: A decrease in the size of a

Q258: Refer to Figure 8-8.The government collects tax

Q261: Total surplus with a tax is equal

Q263: When a good is taxed,the burden of

Q364: If a tax shifts the supply curve

Q399: When a tax is levied on buyers