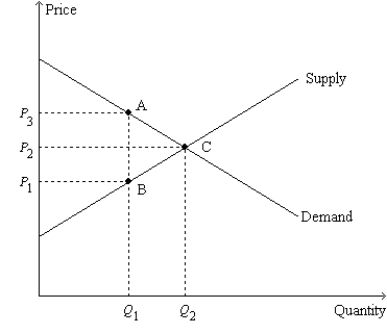

Figure 8-11

-Refer to Figure 8-11.Suppose Q1 = 4;Q2 = 7;P1 = $6;P2 = $8;and P3 = $10.Then the deadweight loss of the tax is

Definitions:

Cumulative Frequency

The sum of frequencies accumulated up to a certain point in a distribution, showing the number or proportion of observations below a particular value.

Cumulative Relative Frequency

The accumulation of the previous relative frequencies up to a certain class or point, representing the proportion of observations.

Percentage

A proportion or share represented as a fraction of 100, used to express how large or small one quantity is relative to another quantity.

Hours Worked

The total time spent by an individual performing tasks or activities related to employment within a specified period.

Q48: Economists generally believe that,although there may be

Q91: Which tools allow economists to determine if

Q113: Refer to Figure 8-7.Suppose a 22nd unit

Q121: Refer to Figure 8-1.Suppose the government imposes

Q200: Refer to Figure 9-2.The world price for

Q255: The Social Security tax is a tax

Q285: Refer to Figure 9-4.Which of the following

Q364: If a tax shifts the supply curve

Q384: If the labor supply curve is very

Q395: When a tax is imposed on the