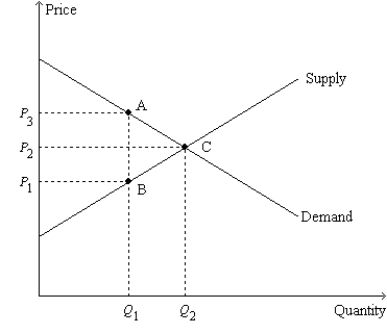

Figure 8-11

-Refer to Figure 8-11.Suppose Q1 = 4;Q2 = 7;P1 = $6;P2 = $8;and P3 = $10.Then,when the tax is imposed,

Definitions:

Standard Unit Cost

The fixed cost calculated to produce one unit of a product, including labor, materials, and overhead.

Materials Price Variance

Refers to the difference between the actual cost of materials and the expected (or standard) cost.

Materials Quantity Variance

A measure of the difference between the actual quantity of materials used in production and the expected (or standard) quantity, indicating efficiency.

Manufacturing Overhead Controllable Variance

Manufacturing Overhead Controllable Variance is the difference between the budgeted and actual manufacturing overhead costs that management has control over.

Q2: At present,the maximum legal price for a

Q29: Refer to Table 7-11.Both the demand curve

Q44: Raisin bran and milk are complementary goods.A

Q58: The nation of Fastbrooke forbids international trade.In

Q81: Suppose England exports cars to Australia and

Q121: Refer to Figure 8-1.Suppose the government imposes

Q172: Assume that for good X the supply

Q252: Refer to Figure 9-9.Consumer surplus in this

Q257: Refer to Figure 7-19.At equilibrium,consumer surplus is

Q460: Refer to Figure 7-15.If the government imposes