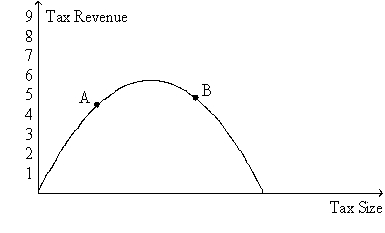

Figure 8-19. The figure represents the relationship between the size of a tax and the tax revenue raised by that tax.

-Refer to Figure 8-19.The curve that is shown on the figure is called the

Definitions:

Actuarial Loss

A loss recognized when the actual experience under a pension plan deviates from expected assumptions, resulting in increased liabilities or decreased assets.

Unrecognized Actuarial (Gain)Loss

Financial gains or losses in pension plans or other post-employment benefit plans that have not been recognized in financial statements.

Income Statement Reporting

The process of presenting revenue, expenses, and profits or losses over a specific period in an income statement.

Other Postretirement Benefits

Benefits, other than pension distributions, that an employee is entitled to receive after retirement, such as life insurance and medical benefits.

Q55: Refer to Figure 8-11.The price labeled as

Q76: Refer to Figure 9-3.Relative to a no-trade

Q77: Tax revenues increase in direct proportion to

Q83: Refer to Figure 8-7.As a result of

Q114: Refer to Figure 8-10.Suppose the government imposes

Q255: The Social Security tax is a tax

Q307: If Darby values a soccer ball at

Q323: When a nation first begins to trade

Q417: Which of the following is a tax

Q468: Producer surplus is the cost of production