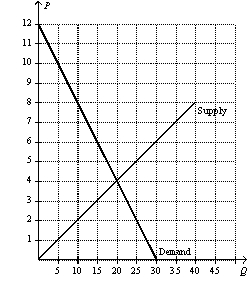

Figure 8-1

-Refer to Figure 8-1.Suppose a $3 per-unit tax is placed on this good.The tax causes the price paid by buyers to

Definitions:

Borrowed

The act of receiving something with the intention to return it, often referring to money in financial contexts.

Matured

Used to describe financial instruments or investments that have reached their due date for payment or realization.

Investment

Allocation of resources, usually money, with the expectation of generating an income or profit.

Income Tax Overpayment

A situation where an individual or entity has paid more income tax to the government than was actually owed.

Q81: Refer to Scenario 8-1.Suppose that a tax

Q109: Refer to Figure 8-2.The amount of tax

Q128: Refer to Scenario 9-2.Suppose the world price

Q161: Suppose that a university charges students a

Q230: A tax on a good<br>A) raises the

Q285: Refer to Figure 8-5.Consumer surplus before the

Q343: A deadweight loss is a consequence of

Q353: In 2008,the Los Angeles Times asked members

Q357: To fully understand how taxes affect economic

Q435: Which of the following statements is correct