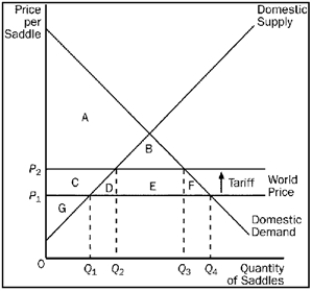

Figure 9-15

-Refer to Figure 9-15.Producer surplus with trade and without a tariff is

Definitions:

Federal Personal Income Tax

A tax levied by the federal government on the yearly income of individuals, with the rate applied varying according to the income level.

Progressive Taxes

A tax system in which the tax rate increases as the taxable amount increases, placing a higher tax burden on individuals with higher incomes.

Proportional Taxes

A tax system where the tax rate remains constant regardless of the amount on which the tax is imposed, resulting in taxes being proportionate to the income.

Direct Taxes

Taxes paid directly to the government by the individual or organization on whom it is levied, such as income tax or property tax.

Q74: Refer to Figure 9-5.If this country allows

Q190: With a corrective tax,the supply curve for

Q224: According to the principle of comparative advantage,all

Q230: Refer to Figure 9-3.With no trade allowed,how

Q254: Regulations to reduce pollution<br>A) cause pollution levels

Q257: When a country allows trade and becomes

Q334: If Argentina exports oranges to the rest

Q366: Refer to Figure 9-5.Without trade,total surplus amounts

Q394: Refer to Figure 10-10.Which of the following

Q448: An externality is<br>A) the costs that parties