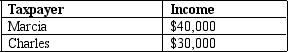

Table 12-8

-Refer to Table 12-8.If the government imposes a $2,000 lump-sum tax,the average tax rate for Marcia and Charles would be

Definitions:

Pension Plan

An employment-based savings program where an employer must deposit funds into a designated account intended for an employee's retirement benefits.

Profit Sharing

A compensation strategy where employees receive additional payments based on the company's profitability, beyond their standard salaries or wages.

Social Responsibility

The idea that businesses should balance profit-making activities with activities that benefit society; encompasses everything from charity work to reducing carbon footprints.

Management Report Card

An evaluative tool or document that assesses and summarizes the effectiveness and performance of a company's management team.

Q87: Accounting profit is equal to<br>A) marginal revenue

Q90: Why do wild salmon populations face the

Q98: Refer to Table 13-1.What is total output

Q117: A textbook is a<br>A) private good and

Q294: Under a regressive tax system,<br>A) the marginal

Q324: Suppose Jack values an ice cream sundae

Q344: Refer to Table 12-2.If Livi has taxable

Q364: Refer to Table 12-1.If Betina has $170,000

Q439: A tax on the wages that a

Q457: The U.S.tax burden is<br>A) about the same