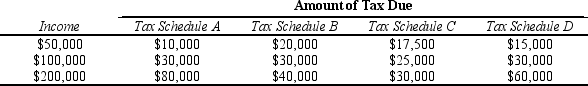

Table 12-11

The following table presents the total tax liability for an unmarried taxpayer under four different tax schedules for the income levels shown.

-Refer to Table 12-11.For an individual with $200,000 in taxable income,which tax schedule has the lowest average marginal tax rate?

Definitions:

Excessive Toe-in

An alignment condition where the front of the wheels are closer to each other than the rear, which can cause uneven tire wear and handling issues.

Accelerated Tire Wear

The faster than normal deterioration of tire tread, often due to improper alignment, balance, or vehicle operation.

Directional Tracking

The ability of a vehicle to maintain a straight path or follow a desired course with minimal driver input.

Multi-axle Vehicle

Multi-axle vehicle is a term for vehicles equipped with more than the standard two axles, providing additional support for heavy loads or improving maneuverability.

Q8: A recent increase in federal gasoline taxes

Q15: Refer to Table 13-2.What is the marginal

Q28: In the 1980s,President Ronald Reagan argued that

Q46: From the time of Benjamin Franklin to

Q112: Refer to Table 12-6.What is the marginal

Q122: Refer to Scenario 12-4.The taxpayer faces<br>A) an

Q248: Refer to Table 12-1.If Betina has $170,000

Q325: Tax evasion is<br>A) facilitated by legal deductions

Q340: Refer to Figure 13-3.Assuming that the firm

Q350: Which of the following are taxed?<br>A) both