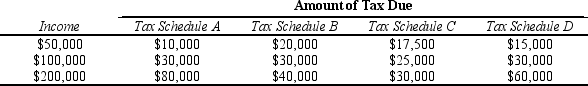

Table 12-11

The following table presents the total tax liability for an unmarried taxpayer under four different tax schedules for the income levels shown.

-Refer to Table 12-11.For an individual with $200,000 in taxable income,which tax schedule has the highest average tax rate?

Definitions:

FICA-Medicare

A component of FICA taxes, withheld from employee wages and matched by employers, to fund the Medicare health insurance program.

FICA-OASDI

Tax contributions made by both employees and employers to fund the Social Security program, covering retirement, disability, and survivorship benefits under the Federal Insurance Contributions Act.

FICA Tax Rate

The combined rate for Social Security and Medicare taxes that employers and employees must pay on wages.

OASDI

Old-Age, Survivors, and Disability Insurance, a comprehensive federal benefits program that includes retirement, disability, and survivors benefits.

Q4: The "other" category of federal spending consists

Q21: Corporate income taxes are based on the

Q116: Cindy's Car Wash has average variable costs

Q187: Which of the following costs of publishing

Q278: Maurice faces a progressive federal income tax

Q298: In the absence of taxes,Ashley would prefer

Q348: Refer to Table 12-6.What is the marginal

Q354: Refer to Table 12-14.A regressive tax is

Q367: Many people consider lump-sum taxes to be

Q477: The marginal tax rate for a lump-sum