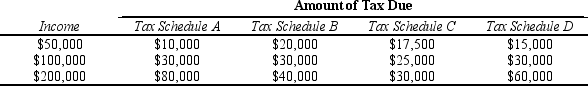

Table 12-11

The following table presents the total tax liability for an unmarried taxpayer under four different tax schedules for the income levels shown.

-Refer to Table 12-11.Which tax schedule could be considered a lump-sum tax?

Definitions:

Marketer

A person or company responsible for promoting and selling products or services, including market research and advertising.

Dividend Ratio

A financial ratio that shows how much a company pays out in dividends each year relative to its share price.

Financial Ratio

A numerical comparison derived from a company's financial statements that investors use to analyze a company's performance.

Shareholders

Individuals, companies, or institutions that own at least one share of a company's stock, and as a result, potentially benefit from its success in the form of dividends and/or capital gains.

Q8: Jacqui decides to open her own business

Q12: Refer to Table 12-14.A proportional tax is

Q22: Which of the following expressions is correct?<br>A)

Q33: Refer to Table 12-10.Which of the following

Q67: Refer to Table 12-14.A progressive tax is

Q116: Cindy's Car Wash has average variable costs

Q143: Which of the following can be added

Q348: Refer to Table 12-6.What is the marginal

Q351: In which of the following examples are

Q441: Suppose a country imposes a lump-sum income