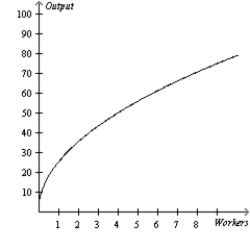

Figure 13-2

-Refer to Figure 13-2. If the figure represented production at a cookie factory, the factory would be experiencing

Definitions:

Differential Tax Rates

Different rates of taxation applied to different levels of income, types of taxpayers, or types of activities, to achieve various economic or social objectives.

Effective Rate

The interest rate on a loan or financial product, re-calculated to include all fees and compounded interest, showing the true cost of the loan over its term.

Deferred Taxes

Taxes that are due on income or transactions that have been recorded in the financial statements but have not yet been settled in cash.

Tax Contingency Reserve

A tax contingency reserve is an accounting provision made to cover potential tax liabilities that may arise due to uncertainties in the interpretation of tax laws or disputes with tax authorities.

Q42: Profit is defined as total revenue<br>A) plus

Q45: When a factory is operating in the

Q127: Most economists believe that a corporate income

Q136: Which of the following statements best reflects

Q181: According to the benefits principle,it is fair

Q195: Why does a firm in a competitive

Q387: Suppose the government taxes 30 percent of

Q459: What might cause economies of scale?

Q473: Refer to Figure 13-5.Curve D is increasing

Q490: Which of the following factors is most