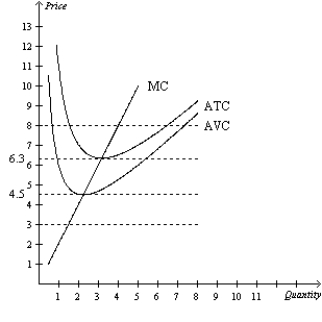

Figure 14-1

Suppose that a firm in a competitive market has the following cost curves:

-Refer to Figure 14-1. If the market price is $5.00, the firm will earn

Definitions:

Standard Deviations

A statistical measure of the dispersion or variability of a set of data points or investment returns from their average value.

Expected Return

The weighted average of the probable returns of an investment, calculated based on past performance or statistical analyses.

Market Risk Premium

The additional return expected from holding a risky market portfolio over a risk-free asset.

Beta

An indicator of how volatile a stock is compared to the general market, where a beta greater than 1 signifies volatility above the market average.

Q106: Refer to Figure 14-4.When price rises from

Q138: One difference between a perfectly competitive firm

Q201: Refer to Figure 14-1.The firm should shut

Q234: Bubba is a shrimp fisherman who catches

Q252: Competitive firms differ from monopolies in which

Q283: Refer to Table 13-1.The average total cost

Q310: If a monopolist can sell 7 units

Q360: Refer to Table 13-2.What is the marginal

Q374: An example of an explicit cost for

Q451: Refer to Table 15-3.To maximize profit,the monopolist