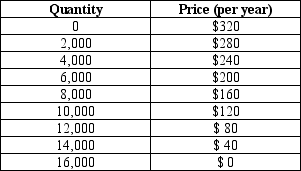

Table 17-4. The information in the table below shows the total demand for high-speed Internet subscriptions in a small urban market. Assume that each company that provides these subscriptions incurs an annual fixed cost of $200,000 (per year) and that the marginal cost of providing an additional subscription is always $80.

-Refer to Table 17-4.Assume there are two profit-maximizing high-speed Internet service providers operating in this market.Further assume that they are able to collude on the quantity of subscriptions that will be sold and on the price that will be charged for subscriptions.How much profit will each company earn?

Definitions:

Amortization

The gradual reduction of a debt over a period of time through regular payments that cover principal and interest.

Semiannually

Occurring twice a year or every six months.

Interest Payments

The amount of money paid regularly (typically annually or semiannually) for the use of borrowed funds.

Callable Bonds

Bonds that can be redeemed by the issuer prior to their maturity date at a specified call price.

Q5: Although the practice of predatory pricing is

Q85: In a long-run equilibrium,both perfectly competitive markets

Q152: Which of the following questions about predatory

Q153: Which of the following is not an

Q166: Refer to Table 17-1.If Rochelle and Alec

Q179: Long-run profit earned by a monopolistically competitive

Q207: Refer to Table 17-4.Suppose there is only

Q340: Consider a game of the "Jack and

Q374: When advertising is used to relay information

Q396: If regulators required firms in monopolistically competitive