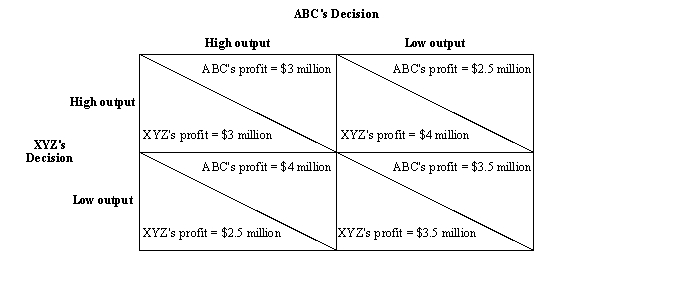

Figure 17-1. Two companies, ABC and XYZ, each decide whether to produce a high level of output or a low level of output. In the figure, the dollar amounts are payoffs and they represent annual profits for the two companies.

-Refer to Figure 17-1.Which of the following statements is correct?

Definitions:

Capital Budgeting Decisions

The process of making investment decisions in long-term assets and projects, based on their expected cash flows and potential for returns.

Cash Inflows

The total amount of money being received by a company from its various business activities, such as sales revenue, investments, and loans.

Cash Outflows

Cash outflows represent money leaving a business, covering expenses like payroll, rent, materials, and other operational costs, crucial for cash flow management.

Present Value

The current value of a future amount of money or stream of cash flows, discounted back to the present using a specific discount rate.

Q38: Briefly describe the business practice of tying.

Q78: Senator Hubris wants to pass a law

Q107: An oligopoly would tend to restrict output

Q211: Refer to Table 18-9.This table describes the

Q227: Economists use game theory to analyze _.

Q312: Refer to Table 17-3.Assume there are two

Q315: Which of the following statements is correct?<br>A)

Q322: Refer to Scenario 16-1.Which of the following

Q357: Refer to Table 18-6.What is the value

Q373: Refer to Table 18-6.To maximize its profit,the