Table 17-19

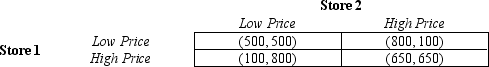

Consider a small town that has two grocery stores from which residents can choose to buy a gallon of milk. The store owners each must make a decision to set a high milk price or a low milk price. The payoff table, showing profit per week, is provided below. The profit in each cell is shown as (Store 1, Store 2) .

-Refer to Table 17-19.If grocery store 1 sets a high price,what price should grocery store 2 set? And what will grocery store 2's payoff equal?

Definitions:

Corporate Alternative Minimum Tax

A parallel tax system aimed at ensuring that corporations pay at least a minimum amount of tax, regardless of deductions or credits that would otherwise lower their tax bill.

Exemption Amount

This refers to a specific dollar amount that taxpayers can claim for themselves and their dependents to reduce taxable income.

Parent-Subsidiary Group

A group consisting of a parent company and one or more subsidiaries, which are companies controlled by the parent company.

Common Parent Corporation

A corporation that holds a controlling interest in subsidiary companies, forming a corporate group or family.

Q4: Of the total income earned in the

Q156: Even when allowed to collude,firms in an

Q214: The Sherman Antitrust Act prohibits executives of

Q218: An agreement among firms regarding price and/or

Q220: Refer to Table 17-19.What is the Nash

Q236: An equilibrium occurs in a game when<br>A)

Q284: Refer to Table 18-10.What is the sixth

Q304: Entry of new firms in monopolistically competitive

Q323: Refer to Table 17-19.What is grocery store

Q339: In Lee Benham's 1972 article examining the