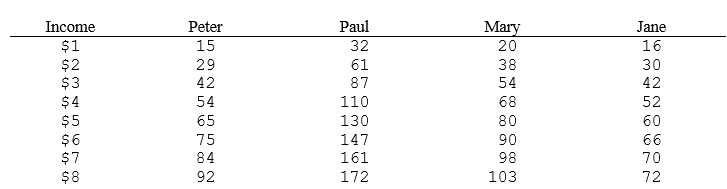

The table below reflects the levels of total utility received from income for each of four members of a society.

a.Assume that the society has the following income distribution:

Peter $3

Paul $7

Mary $5

Jane $3

Is it possible for the government to increase total aggregate utility by redistributing income among members of society? Explain your answer.

b.Assume that the government has $19 to allocate among the four members of society.(Assume that no one has any income to start with. )If the government is interested in distributing income in a way that maximizes aggregate total utility,how should it distribute the $19 of income?

c.Does the table above describe a situation characterized by diminishing marginal utility? Explain your answer.

Definitions:

Bear Burden

To carry or endure an obligation, duty, or hardship, especially in the context of paying taxes.

Labor Economists

Labor economists are experts who study the labor force, examining employment levels, wage dynamics, and the factors affecting labor market participation and efficiency.

Supply Elastic

A measure of how much the quantity supplied of a good or service changes in response to a change in price.

Luxury Tax

A tax placed on expensive, non-essential products or services, aimed at curbing the consumption of luxury goods.

Q59: Refer to Figure 21-19.Assume that the consumer

Q68: Indifference curves that cross would suggest that<br>A)

Q93: Bundle A contains 10 units of good

Q99: Jack and Diane each buy pizza and

Q169: Steak and pasta are normal goods.When the

Q202: The Supplemental Security Income (SSI)program focuses on

Q206: Liberalism aims to raise the welfare of

Q283: Refer to Figure 21-7.Suppose the price of

Q374: Refer to Figure 21-22.When the price of

Q390: The regular pattern of income variation over