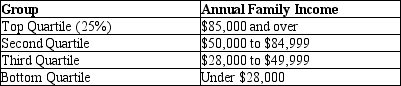

Table 20-1

The following table shows the distribution of income in Thomasville.

-Refer to Table 20-1.Seventy-five percent of all families have incomes below what level?

Definitions:

Taxable Temporary Difference

The difference between the tax base of an asset or liability and its carrying amount in the financial statements that will result in taxable amounts in future periods.

Deferred Tax Asset

An accounting term that refers to a situation where a company has paid more taxes to the government than it has shown as an expense in its financial statements, leading to future tax savings.

Deferred Tax Liability

A tax obligation that a company owes but is allowed to pay at a later date, often due to timing differences between accounting practices and tax laws.

Future Tax

Tax liabilities or assets that are expected to be realized in the future, typically as a result of temporary differences between the book and tax bases of assets and liabilities.

Q60: Jake and Bill are both college graduates.Jake

Q162: Jobs that involve pleasant work,as opposed to

Q187: Which of the following was a recommendation

Q199: Refer to Figure 21-5.Assume that a consumer

Q211: By definition,there is discrimination when the marketplace

Q318: Refer to Figure 21-7.Suppose a consumer has

Q319: Education and on-the-job training are sources of

Q359: When employers pay an efficiency wage above

Q368: Regarding wage differences among various groups of

Q378: Suppose that young people often borrow and