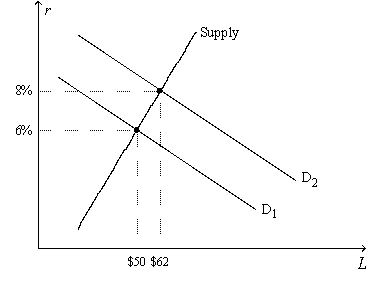

Figure 13-4. On the horizontal axis of the graph, L represents the quantity of loanable funds in billions of dollars.

-Refer to Figure 13-4. If the equilibrium quantity of loanable funds is $56 billion and if the rate of inflation is 4 percent, then the equilibrium real interest rate is

Definitions:

Contract Rate

It is the interest rate stated in a contract, such as a loan or lease agreement.

Non-interest-bearing Notes

Debt instruments that do not accrue interest over time, thus repaid at their face value.

Incremental Borrowing Rate

The interest rate a lessee would have to pay to borrow over a similar term the funds necessary to purchase or lease an asset.

Q27: Other things the same,corporate bonds generally feature

Q95: What do we mean when we say

Q104: Mutual funds<br>A) provide diversification.Shareholders assume all of

Q173: Measured in 2008 dollars,real GDP per person

Q224: The amount of revenue a firm receives

Q245: What is the difference between human capital

Q249: You may be unwilling to buy a

Q350: In the loanable funds model,an increase in

Q461: Rosie is risk averse and has $1,000

Q491: A bond buyer is a<br>A) saver.Long term