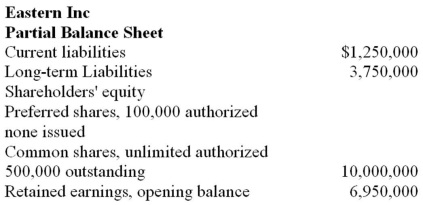

Eastern Inc is in need of $5,000,000 to expand their operations into Western Canada.The projected income statement for the first year of operation after the expansion is shown below.It does not include any of the financing costs.A projected partial balance sheet after the expansion, but before the addition of the new financing, has also been prepared.Eastern is considering three alternatives to raise the $5,000,000.

i) Borrow the full amount from the bank in the form of a long-term note.Interest would be 8% per annum, and repayments would start in two years.

ii) Issue common shares; the recent average market price has been $50.For the last three years they have paid annual dividends of $0.10 per share.

iii) Issue cumulative preferred shares with a $2 annual dividend at $80 per share. Eastern Inc

Projected Income Statement

Required:

Required:

A) Calculate the net income for Eastern under each of the three alternatives.

B) Calculate the EPS and ROE for Eastern under each of the three alternatives.Use year-end balances in your calculations.

C) Which alternative would you recommend to them? Support your recommendation.

Definitions:

Unrequited Love

A type of love where one person loves another who does not return that love.

Unreciprocated Love

A situation where one person's feelings of love are not returned by the object of their affection.

Stalking

Unwanted and/or repeated surveillance by an individual towards another person, causing fear or distress.

Unrequited Love

A type of love not openly reciprocated or understood as such by the beloved, leaving one person's feelings unreturned.

Q5: Repurchase of a firm's own shares is

Q37: Explain the format and key components of

Q39: Pink desires to purchase a one-fourth

Q44: Offsetting a partner's loan balance against his

Q50: Under the equity method of accounting for

Q52: Three ratios that help the financial analyst

Q69: Bigwin Inc had a loan outstanding during

Q78: All of the following are reasons a

Q86: During 2014, National Tire Company bought

Q88: Brooks Inc.has 750,000 common shares outstanding