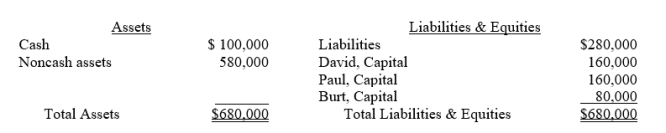

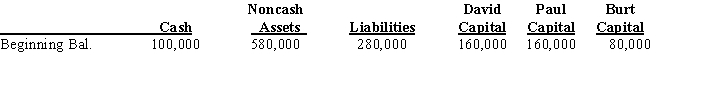

David, Paul, and Burt are partners in a CPA firm sharing profits and losses in a ratio of 2:2:3, respectively.Immediately prior to liquidation, the following balance sheet was prepared:

Required:

Assuming the noncash assets are sold for $160,000, determine the amount of cash to be distributed to each partner assuming all partners are personally solvent.Complete the worksheet and clearly indicate the amount of cash to be distributed to each partner in the spaces provided.

Definitions:

Disease Prevention

Measures or activities aimed at reducing the risk or incidence of health problems and diseases.

Plan of Action

A detailed strategy outlining steps needed to achieve an objective or goal.

Diverse Factors

A variety of elements or conditions that contribute to the complexity or outcome of a situation.

Surrounding Society

The social environment and community that envelops an individual or group, influencing their behaviors and beliefs.

Q10: Board designated funds should be accounted for

Q10: During 2014, Airdrie Company discovered that

Q12: As mentioned in Chapter 1, the project

Q12: On January 1 2013, Paulus Company purchased

Q19: What are some of the methods commonly

Q28: What are the major classifications of increases

Q34: The partnership of Mick, Keith, and

Q39: Explain the differences between long-term notes payable,

Q40: Explain the differences between accounts payable, short-term

Q80: For which of the following organizations would