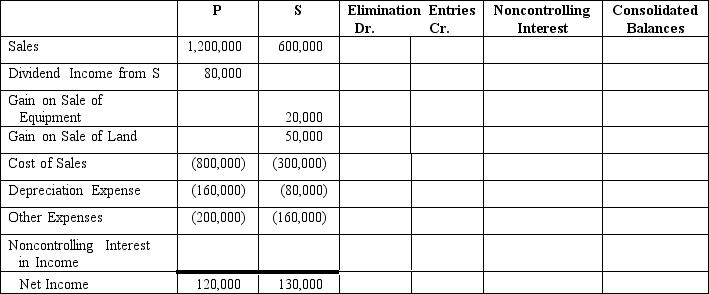

P Corporation acquired 80% of the outstanding voting stock of S Corporation when the fair values equaled the book values.

On July 1, 2013, P sold land to S for $300,000.The land originally cost P $200,000.S recently resold the land on October 30, 2014 for $350,000.

On October 1, 2014, S Corporation sold equipment to P Corporation for $80,000.S originally paid $100,000 for this equipment and had accumulated depreciation of $40,000 thus far.The equipment has a five-year remaining life.

Required:

A.Complete the consolidated income statement for P Corporation and subsidiary for the year ended December 31, 2014.

Definitions:

Ending Inventory

The value of goods available for sale at the end of an accounting period, calculated as beginning inventory plus purchases minus cost of goods sold.

Net Realizable Value

The estimated selling price in the ordinary course of business, minus the estimated costs necessary to make the sale.

Inventory Purposes

The reasons for keeping stock of goods in a business, typically for sale, production, or avoiding stockouts.

Direct Costs

Expenses that can be directly traced to a product or service, such as materials and labor.

Q2: Pizza Company purchased Salt Company common stock

Q10: On December 31, 2013, Priestly Company purchased

Q15: What amount of goodwill will be reported?<br>A)$26,667.<br>B)$20,000.<br>C)$42,000.<br>D)$86,667.

Q19: How does the adoption of a budget

Q22: P Corporation purchased an 80% interest in

Q23: What amount of goodwill will be reported?<br>A)($20,000)<br>B)($25,000)<br>C)$25,000<br>D)$0

Q26: Companies using the LIFO method may encounter

Q32: The following balance sheet information is for

Q37: A 90% owned subsidiary sold merchandise at

Q43: A component of an enterprise that may