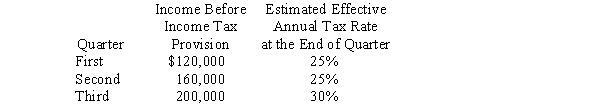

Bjork, a calendar year company, has the following income before income tax provision and estimated effective annual income tax rates for the first three quarters of 2014:  Bjork's income tax provision in its interim income statement for the third quarter should be

Bjork's income tax provision in its interim income statement for the third quarter should be

Definitions:

Cardio Activity

Any exercise that raises your heart rate, strengthening the cardiovascular system.

Pedometer

A device that counts the number of steps taken by a user, estimating the distance walked or run.

Highly Active

Reflects a lifestyle or level of activity that significantly exceeds the average, often involving rigorous and frequent physical exercise.

Average Steps

The typical number of steps a person takes in a day, used as a basic metric for physical activity levels.

Q3: The following balance sheet information is for

Q7: Which basis of accounting should a voluntary

Q9: Pruin Corporation acquired all of the voting

Q26: New terminology introduced under the joint IFRS-

Q29: Financial ratio data is listed below

Q31: Investments are reported by NNOs at<br>A)cost.<br>B)fair value.<br>C)the

Q32: On January 1, 2014, Pioneer Company

Q36: Distinguish between an expense and an expenditure.

Q37: All of the following statements about the

Q40: What is the "loss absorption potential"?