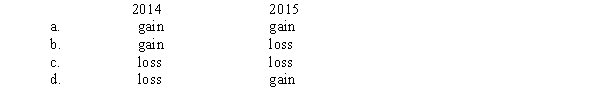

During 2014, a U.S.company purchased inventory from a foreign supplier.The transaction was denominated in the local currency of the seller.The direct exchange rate increased from the date of the transaction to the balance sheet date.The exchange rate decreased from the balance sheet date to the settlement date in 2015.For the years 2014 and 2015, transaction gains or losses should be recognized as:

Definitions:

Net Income

The total profit of a company after all expenses and taxes have been deducted from revenues, indicating the company's profitability.

Sales Increase

A rise in the amount of goods or services sold by a company, indicating a growth in revenue.

Additional Debt

New borrowing taken on by a company or individual, in addition to any existing debt.

Maximum Capacity

The highest level of output that a company can sustain to make a product or provide a service.

Q10: Giraldi Company has identified that the cost

Q12: The SEC requires the use of push

Q12: The parent company concept of consolidation represents

Q16: When the acquisition price of an acquired

Q16: Discuss the methods used to record changes

Q19: Gains from remeasuring a foreign subsidiary's financial

Q24: Lyme Corporation entered into a troubled debt

Q26: Joey and Rachel are partners whose capital

Q27: Which of the following reporting practices is

Q34: In accounting for expendable fund entities, revenue