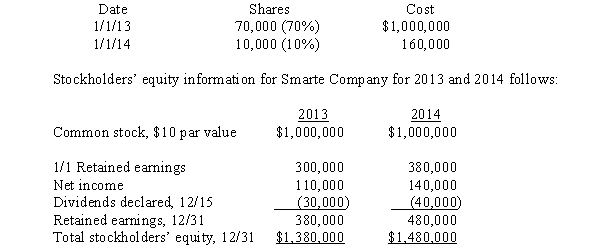

Poole made the following purchases of Smarte Company common stock:

On July 1, 2014, Poole sold 14,000 shares of Smarte Company common stock on the open market for $22 per share.The shares sold were purchased on January 1, 2013.Smarte notified Poole that its net income for the first six months was $70,000.Any difference between cost and book value relates to subsidiary land.Poole uses the cost method to account for its investment in Smarte Company.

Required:

A.Prepare the journal entry made by Poole to record the sale of the 14,000 shares on July 1, 2014.

B.Prepare the workpaper eliminating entries needed for a consolidated statements workpaper on December 31, 2014.

C.Compute the amount of noncontrolling interest that would be reported on the consolidated balance sheet on December 31, 2014.

Definitions:

Exclusion

A decision or practice of leaving someone or something out of a group, activity, or benefit.

Antitrust Enforcement

The legal processes and actions by which governmental authorities regulate, restrict, or prevent monopolistic practices and promote competition.

Vertical Relationships

Interactions between businesses or entities at different levels of the supply chain, such as manufacturers and retailers.

Market Power

The ability of a company or group of companies to manipulate or influence the price and production levels in the market to their advantage.

Q2: On January 1, 2013, Pultey Company acquired

Q6: The rate that a company must pay

Q10: Accounting terminology that differs between IFRS and

Q11: When the goodwill method is used to

Q17: List some of the alternative methods of

Q20: Differentiate between the admission of a new

Q29: In years subsequent to the year of

Q38: The constructive gain or loss on an

Q55: Unfavorable materials price and quantity variances

Q124: A company developed the following per-unit standards