Use the following information for Questions 22 & 23:

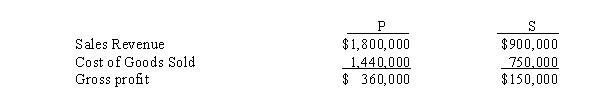

P Company regularly sells merchandise to its 80%-owned subsidiary, S Corporation.In 2013, P sold merchandise that cost $192,000 to S for $240,000.Half of this merchandise remained in S's December 31, 2013 inventory.During 2014, P sold merchandise that cost $300,000 to S for $375,000.Forty percent of this merchandise inventory remained in S's December 31, 2014 inventory.Selected income statement information for the two affiliates for the year 2014 is as follows:

-Consolidated cost of goods sold for P Company and Subsidiary for 2014 are:

Definitions:

Fair Market Value

The price at which property would sell between a willing buyer and a willing seller, each having reasonable knowledge of all relevant facts and not under any compulsion to transact.

Appraised Value

The estimated monetary value of an asset determined by a professional appraiser at a specific point in time.

Depreciated

Refers to the reduction in the recorded value of an asset over time due to wear and tear, obsolescence, or age.

Equipment

Tangible assets used in operations, such as machinery or office hardware, that play a key role in business operations and productivity.

Q2: Park Company acquired a 90% interest in

Q4: Sales from one subsidiary to another are

Q10: The process of translating the accounts of

Q11: Long Corporation's revenues for the year ended

Q13: Assets transferred by the debtor to a

Q22: Which of the following situations best describes

Q24: P Company purchased 90% of the outstanding

Q31: Describe the tax treatment of partnership income.

Q64: The predetermined overhead rate for Zane Company

Q154: The cash payback period is computed by