Use the following information for Questions 24 & 25:

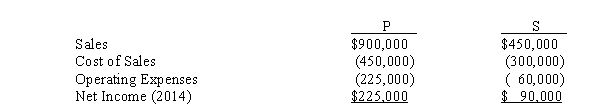

P Company owns an 80% interest in S Company.During 2014, S sells merchandise to P for $150,000 at a profit of $30,000.On December 31, 2014, 50% of this merchandise is included in P's inventory.Income statements for P and S are summarized below:

-Noncontrolling interest in income for 2014 is:

Definitions:

True Value

The genuine or actual worth of an item, service, or financial instrument as determined by underlying characteristics and market conditions.

Valid Contract

An agreement between two or more parties that is enforceable by law and meets all the legal requirements.

Legality

The state or condition of being in accordance with the law; adherence to and conformity with legal statutes, rules, and standards.

Consideration

The benefit, interest, right, or value given to one party in exchange for some act or promise in a contract.

Q4: An NNO obtained cash for the acquisition

Q8: On November 1, 2014, American Company sold

Q12: A city should record depreciation as an

Q18: The major difference between IFRS and US

Q21: Parr Company owned 24,000 of the

Q29: Inventory losses from market declines that are

Q33: P Company purchased 80% of the outstanding

Q41: On October 1, 2014, Pamela Company purchased

Q109: The terms "direct fixed costs" and "indirect

Q145: An unfavorable labor quantity variance indicates that