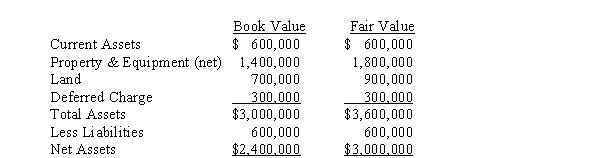

Plain Corporation acquired a 75% interest in Swampy Company on January 1, 2013, for $2,000,000.The book value and fair value of the assets and liabilities of Swampy Company on that date were as follows:

The property and equipment had a remaining life of 6 years on January 1, 2013, and the deferred charge was being amortized over a period of 5 years from that date.Common stock was $1,500,000 and retained earnings was $900,000 on January 1, 2013.Plain Company records its investment in Swampy Company using the cost method.

Required:

Prepare, in general journal form, the December 31, 2013, workpaper entries necessary to:

A.Eliminate the investment account.

B.Allocate and amortize the difference between implied and book value.

Definitions:

Trust

The confidence or belief in the reliability, truth, ability, or strength of someone or something.

Leader-member Relationship

The dynamic and interaction between a leader and their followers, which can significantly affect performance, motivation, and job satisfaction.

Conscientiousness

A personality trait characterized by diligence, carefulness, and the desire to perform a task well.

Complementary Skill Sets

Diverse abilities and expertise that team members bring to the table, which when combined, enhance team performance and output.

Q8: The following data are taken from the

Q16: The purchase by a subsidiary of some

Q24: In January 2008, S Company, an 80%

Q33: Which of the following is not a

Q33: A foreign subsidiary's functional currency is its

Q37: Under IFRS, the entry to record the

Q50: If a project has a negative net

Q60: Which of the following is true?<br>A)The form,

Q90: The activity index used in preparing a

Q152: The annual rate of return method requires