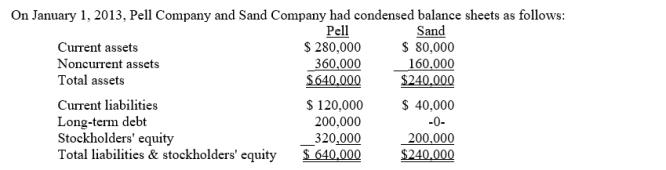

Use the following information for questions .  On January 2, 2013 Pell borrowed $240,000 and used the proceeds to purchase 90% of the outstanding common stock of Sand.This debt is payable in 10 equal annual principal payments, plus interest, starting December 30, 2013.Any difference between book value and the value implied by the purchase price relates to land.

On January 2, 2013 Pell borrowed $240,000 and used the proceeds to purchase 90% of the outstanding common stock of Sand.This debt is payable in 10 equal annual principal payments, plus interest, starting December 30, 2013.Any difference between book value and the value implied by the purchase price relates to land.

On Pell's January 2, 2013 consolidated balance sheet,

-Noncurrent liabilities should be

Definitions:

Term Loans

Loans from financial institutions that are provided with a set amount of money and a specified repayment schedule and maturity date.

Debt SEOs

Secondary Equity Offerings specifically oriented towards raising funds to pay down existing debt, involving the issuance of new stock.

Best Efforts Underwriting

A type of underwriting where the underwriter agrees to sell as much of the offering as possible, but does not guarantee the sale of the entire issue.

Flotation Costs

Costs associated with the issuance of new securities by a firm, including charges for underwriting, legal services, and registration.

Q1: Which of the following funds frequently does

Q7: If project A has a lower internal

Q8: A newly acquired subsidiary has pre-existing goodwill

Q8: Which of the following funds of a

Q9: Benaflek Co. purchased some equipment 3

Q13: The primary beneficiary of a variable interest

Q15: Military Family Center is a voluntary welfare

Q24: In what account is the difference between

Q33: Pell Company purchased 90% of the stock

Q119: Capital budgeting is the process<br>A)used in sell