Use the following information to answer questions

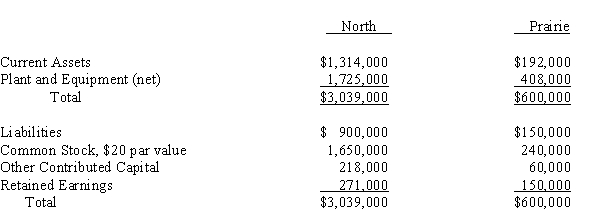

North Company issued 24,000 shares of its $20 par value common stock for the net assets of Prairie Company in business combination under which Prairie Company will be merged into North Company.On the date of the combination, North Company common stock had a fair value of $30 per share.Balance sheets for North Company and Prairie Company immediately prior to the combination were as follows:

-If the business combination is treated as an acquisition and Prairie Company's net assets have a fair value of $686,400, North Company's balance sheet immediately after the combination will include goodwill of

Definitions:

Repairs

Activities or processes aimed at restoring a damaged, broken, or malfunctioning object to its original or operating condition.

Risk-Averse

Risk-averse describes individuals or entities that prefer to avoid risk and would rather choose a certain outcome over a gamble with potentially higher, but uncertain, rewards.

Expected Value

The anticipated value for an investment or probability-weighted average of all possible values in a probabilistic scenario.

Total Wealth

The complete sum of an individual's or entity's assets and resources, including both tangible and intangible assets, subtracting any debts owed.

Q7: On January 2, 2013, Pope Company acquired

Q10: On December 31, 2013, Priestly Company purchased

Q18: On January 1, 2013, P Corporation purchased

Q20: Revenues and expenses of hospitals are recorded

Q20: Consolidated sales revenue for P and Subsidiary

Q22: P Corporation purchased an 80% interest in

Q52: A responsibility report should<br>A)be prepared in accordance

Q133: If the internal rate of return is

Q145: An unfavorable labor quantity variance indicates that

Q153: Using the annual rate of return method,