Use the following information to answer questions

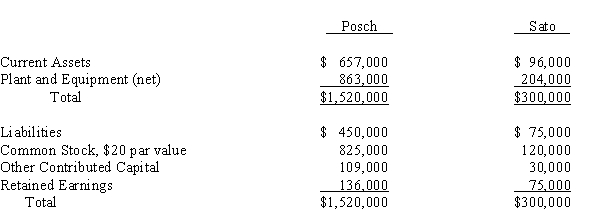

Posch Company issued 12,000 shares of its $20 par value common stock for the net assets of Sato Company in a business combination under which Sato Company will be merged into Posch Company.On the date of the combination, Posch Company common stock had a fair value of $30 per share.Balance sheets for Posch Company and Sato Company immediately prior to the combination were as follows:

-If the business combination is treated as an acquisition and the fair value of Sato Company's current assets is $135,000, its plant and equipment is $363,000, and its liabilities are $84,000, Posch Company's financial statements immediately after the combination will include

Definitions:

Transferred Item

Goods that are moved from one process, department, or location to another within the same company.

Outside Supplier

A third-party entity that provides goods or services to a business.

Residual Income

Income that remains after all operating expenses, including cost of capital, are subtracted from revenue, often used in performance measurement.

Investment Center

A business segment whose manager has control over cost, revenue, and investments in operating assets.

Q5: P Company purchased land from its 80%

Q8: If an impairment loss is recorded on

Q8: Which of the following funds of a

Q15: For state and local government units, the

Q20: Which of the following will cause the

Q27: Explain how to account for the difference

Q27: Which of the following reporting practices is

Q28: A disadvantage of the cash payback technique

Q29: On December 31, 2014, Pilot's Credit Union

Q121: A company projects an increase in net