Use the following information to answer questions

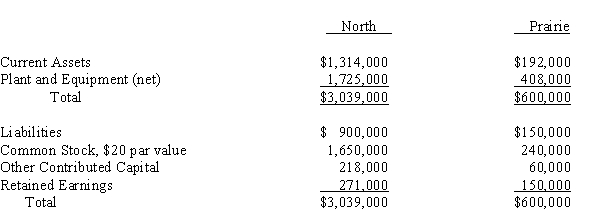

North Company issued 24,000 shares of its $20 par value common stock for the net assets of Prairie Company in business combination under which Prairie Company will be merged into North Company.On the date of the combination, North Company common stock had a fair value of $30 per share.Balance sheets for North Company and Prairie Company immediately prior to the combination were as follows:

-If the business combination is treated as an acquisition and the fair value of Prairie Company's current assets is $270,000, its plant and equipment is $726,000, and its liabilities are $168,000, North Company's financial statements immediately after the combination will include

Definitions:

Initial Cost

The purchase price of an asset or service, including installation, setup, and training, before any depreciation or amortization.

Required Return

The minimum amount of profit an investor expects to achieve on an investment, setting the threshold for decision-making on whether to undertake the investment.

Profitability Index

An instrument in finance for assessing the attractiveness of a project or investment, which is found by dividing the current value of forthcoming cash flows by the initial cost of the investment.

Present Value

The valuation in today's terms of a prospective future sum of money or cash inflows, utilizing a particular return rate.

Q1: The fair value of net identifiable assets

Q4: The following information is available for Pink

Q7: The GASB has the responsibility for establishing

Q12: Which responsibility centers generate both revenues and

Q15: Bark Company is considering buying a machine

Q19: Eliminating entries are made to cancel the

Q26: Define the controlling interest in consolidated net

Q42: All of the following are involved in

Q98: On the basis of the budget reports,<br>A)management

Q105: The standard number of hours that should