Use the following information to answer questions

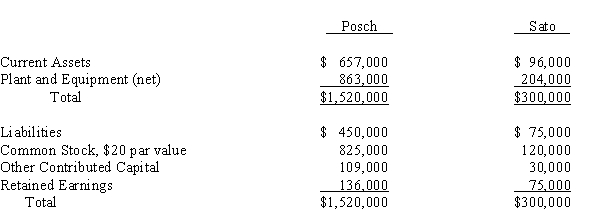

Posch Company issued 12,000 shares of its $20 par value common stock for the net assets of Sato Company in a business combination under which Sato Company will be merged into Posch Company.On the date of the combination, Posch Company common stock had a fair value of $30 per share.Balance sheets for Posch Company and Sato Company immediately prior to the combination were as follows:

-If the business combination is treated as an acquisition and the fair value of Sato Company's current assets is $135,000, its plant and equipment is $363,000, and its liabilities are $84,000, Posch Company's financial statements immediately after the combination will include

Definitions:

Q5: Which of the following is not a

Q11: Of the following choices, which contain both

Q14: Consolidated cost of goods sold for P

Q15: Bark Company is considering buying a machine

Q22: On January 1, 2013, P Corporation sold

Q24: The per-unit standards for direct labor are

Q50: The formula for the materials price variance

Q131: When calculating the annual rate of return,

Q143: The master budget is not used in

Q157: In concept, standards and budgets are essentially